Sunday, February 6, 2022

[NEW] ETF DCA Project 2022/01

Monday, January 10, 2022

Sunday, February 7, 2021

Monthly Investment Summary 2021/Jan

Tuesday, January 5, 2021

Monthly Investment Summary 2020/December

Sunday, October 11, 2020

Monthly Investment Plan - US stocks 10/10/2020

After some deep thoughts and back test, here is my finalised strategy: I will continue to contribute some ETFs such as VOO, QQQ, VXUS, VWO, VGIT, VGLT, ARKK and ARKW. Meanwhile, I will buy V and MA every month. Besides, I will buy AMZN every 6 months. As for the other stocks such as TTD and DIS, I will buy a few shares and hold at least 5 years. In short, my plan is to buy and hold index ETFs with a handful of individual stocks.

TOTAL: $11284.09

Saturday, October 10, 2020

Tuesday, September 8, 2020

Monthly Investment Plan - HK stocks 7/9/2020

I will stop contributing 435 and 3140. For 435, it is because the future of HK is very uncertain. I do not want to bet on it. For 3140, it is because Vanguard will quit the HK market, which is a surprise for me. I sold some of it because of the same reason. The money will be invested to VOO on a monthly basis.

Sunday, August 9, 2020

Monthly Investment Plan - US stocks 8/8/2020

Sunday, July 12, 2020

Monthly Investment Plan - HK Property stocks 8/7/2020

Saturday, July 11, 2020

Monthly Investment Plan - HK ETF 8/7/2020

Saturday, June 27, 2020

Regular Financial Updates 2020 Q2

This is Jerry, the author of this blog! I decided to post the total asset I have so that you guys could witness my growth.

This is the second quarter asset report of 2020:

Sunday, June 7, 2020

Monthly Investment Plan - HK ETF 5/6/2020

I will continue to contribute to 3140 since this is in fact a US ETF. As for 2800, I will stop contribution once a whole lot size is accumulated because of the recent change in social economic environment in HK. The economy is not good around the globe. Unemployment rates are high. Yet, some said the bear market has ended already. I will be bullish technically but stay very cautious about the macro economy.

Saturday, June 6, 2020

Monthly Investment Plan - HK Property stocks 5/6/2020

Sunday, April 26, 2020

Monthly Investment Plan - HK Property stocks 23/4/2020

Will the market go even deeper? I don't know but I will prepare for the worst scenario. Luckily, I have found an extra freelance job recently. My income has increased a little bit.

Saturday, April 25, 2020

Monthly Investment Plan - HK ETF 23/4/2020

Thursday, April 16, 2020

Wednesday, April 15, 2020

Monthly Investment Plan - HK ETF 7/4/2020

Thursday, April 9, 2020

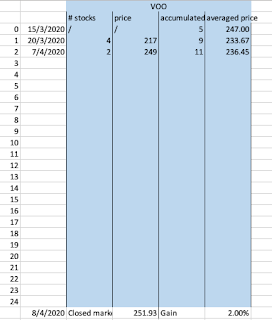

Monthly Investment Plan - US 7/4/2020

Monday, March 23, 2020

Monthly Investment Plan - HK ETF 20/3/2020

Sunday, March 22, 2020

Monthly Investment Plan - HK Property stocks 20/3/2020

There is a disadvantage of the monthly plan of the broker. They always help me buy the stocks at a relatively high price intra-day. Yet, I think the effect should be minimal in the long run as long as I stick to my plan.